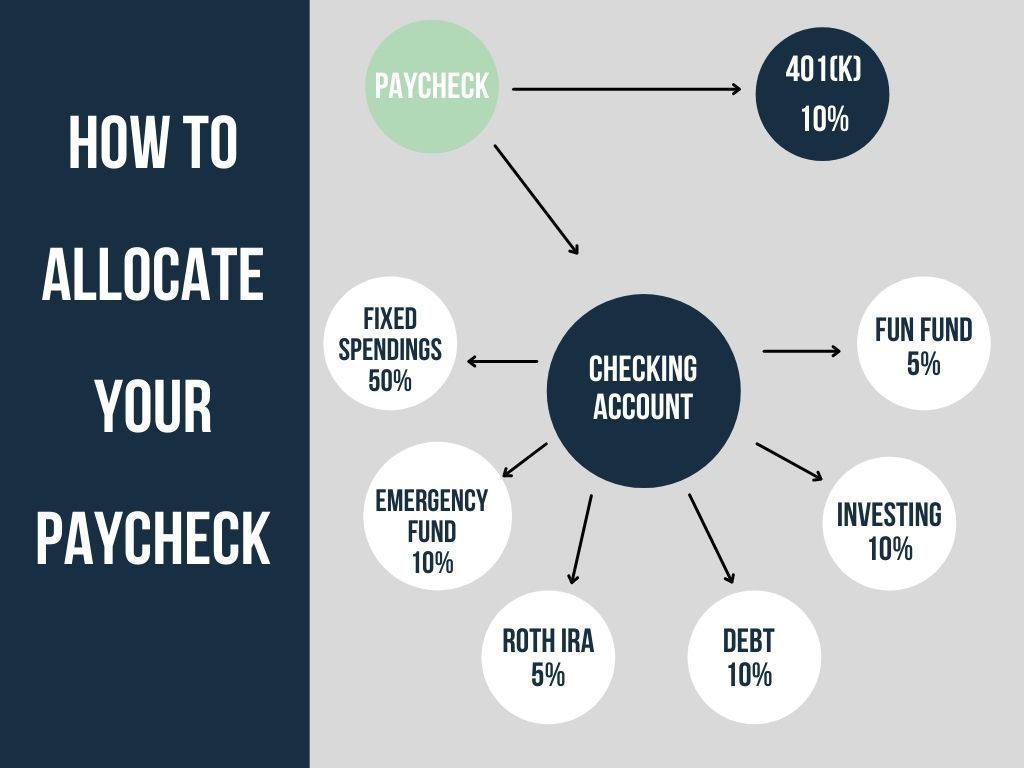

8 Places Your Money Needs to Go When You Get Paid

Ramit Sethi talks about how automating your finances can lead to a happier and more successful financial life in the long term. The way to do that is to make your money work for you by directing it to the right accounts before you start to spend it.

The approach is quite simple, and the returns will be exponential. The idea is to pay yourself first before allocating all of your income to your expenses. Here are eight places your income needs to go for financial growth.

1. Retirement Fund

The first place is actually an account that takes away from your paycheck before you get paid, like your employer’s 401(k) account. Most employers offer a match when you contribute to your 401(k).

Meaning, if you were to contribute 5% of your paycheck, your employer would also match that and contribute 5% on your behalf. In essence, it's free money on the table, so do not leave it.

Plan to contribute 10–15% of your paycheck to retirement funds. Most often, people do not have enough money to retire. The earlier you start, the earlier the money can start compounding into exponential returns.

2. Checking Account

This is the account where the rest of your check is directly deposited. However, the majority of people make the mistake of leaving their entire paycheck in just this one account. Thus, they end up spending all of it because it is easily accessible to them.

From this checking account, you want to set up separate accounts to direct your money to. This helps you set aside money for certain financial goals you might have.

3. Fixed Spending Account

You should have a separate account for all your fixed monthly necessities. This is usually estimated to be 50% of your income. This includes things like:

- Rent/Mortgage

- Utilities

- Groceries

- Healthcare

- Transportation

Calculate the amount you need for your necessities (not your wants) and have it automatically taken out of your checking account every month.

4. Emergency Fund

I cannot stress enough the importance of having an emergency fund. The majority of people underestimate the purpose of having one, which ends up hurting them whenever life throws them a curveball.

You always want to be prepared in case you lose your steady source of income. Thus, plan to save for 3-6 months of fixed expenses in a separate savings account. You can allocate 5-10% of your income to be automatically taken out of your checking account.

Remember, this account is only for emergencies. Do not keep this account with the same bank where you have a checking account. Essentially, you want to make it hard to access the funds from this emergency fund, so choose a different bank for it.

5. Roth IRA

My favorite retirement account is a Roth IRA. An IRA is an individual retirement account. A Roth IRA essentially allows you to invest for retirement but with the ability to withdraw money in retirement tax-free.

Plan to contribute up to 10% of your income to your Roth IRA, but this is part of your retirement fund allocation. A total of 15% of your retirement fund allocation should be split up between your 401(k) and Roth IRA.

There is a yearly contribution limit so make sure to check as it changes frequently. You can start a Roth IRA with brokerages like M1 Finance and Charles Schwab.

6. Debt Payoff

You want to allocate a portion of your paycheck to pay off any debt, especially anything with a higher interest rate than 8%. Plan to allocate 10% of your paycheck to pay off your debt.

When it comes to paying off debt, there are two methods: snowball and avalanche. The latter is my personal favorite because it saves more money and pays off debt faster. However, if you are lacking motivation towards paying off your debt, I would start off with the snowball method.

Snow Ball Method: The debt snowball method involves paying off the smallest debts first to get them out of the way before moving on to bigger ones—kind of a "tackle the easy jobs first" approach - Investopedia

Avalanche Method: The debt avalanche method involves making minimum payments on all your outstanding accounts, then using any of the remaining money earmarked for your debts to pay off the bill with the highest interest rate. - Investopedia

If you have any debt that has an interest rate of upwards of 8–10%, I would consider finishing paying off the debt before moving on to the next step. But if your debt is lower than 7%, then you can pay off debt and start investing simultaneously.

7. Investing

It's crucial that you complete the first five steps before you begin to invest. Investing is perhaps the most exciting piece of the puzzle. Here is where you can make your money work for you and start building your wealth.

You can invest in things like:

- Real Estate/REITs

- Dividend Stocks

- Commodities

- Cryptocurrency

Investing can start off at 10% of your paycheck until you are done with your debt payoff, which then you can increase to 20%. You want to make sure this money is going towards appreciating assets that will have a positive return on investment.

Eventually, these investments will start to grow and you will start to notice the compounding effect on your money. You can get started with any of these apps: M1 Finance, Robinhood, Coinbase, Gemini.

8. Fun Fund

After you have taken the 7 aforementioned steps, you are on a good path to financial success. You deserve to reward yourself and can allocate the rest of your income to your entertainment, which will be about 5-10%. This can be for traveling, fancy cars, or whatever your favorite type of fun is.

The Bottom Line

Financial independence is something many people dream of. By consistently implementing these steps you will be able to save money faster and allocate them to investments that build wealth. The ultimate goal is for your money to buy assets that will earn you money while you sleep.